5 things to consider when you pick a health insurance plan

Picking a health insurance plan can seem overwhelming.

Picking a health insurance plan can seem overwhelming, especially when you have different family members with different needs.

Factors like out-of-pocket costs, in-network providers, and prescription coverage are all important to consider.

Whether you need to estimate your expenses or plan for a big life event, consider these five things to help you choose the right plan based on your needs.

1. Understand what you are going to pay

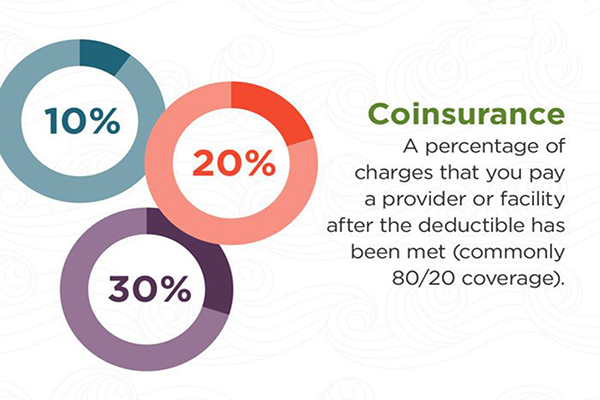

Healthcare costs include several types of payments. They can include a copayment, deductible, and your monthly premium. Before you pick a health insurance plan, know how each of these works and how they can impact your costs.

Copays

A copay, also called a copayment, is a set amount you pay for certain healthcare services, such as going to your primary care provider or getting a prescription. The amount can change based on the type of service you need.

When you need to see a specialist, like a cardiologist or a dermatologist, you may pay a higher copay than when you see your primary care provider.

Deductibles

A deductible is the amount you pay out-of-pocket for covered healthcare services before your insurance kicks in. For example, if your insurance plan has a $1,000 deductible, you’ll pay the first $1,000 for certain services before your insurance will start to cover the costs. Once insurance begins to cover the expenses, you’ll still be responsible for any copay.Premiums

A premium is the amount you pay monthly to keep your health insurance active. If you’re enrolled in an employer-sponsored health plan, your employer will take that premium out of your paycheck to pay the insurance company on your behalf. This payment is separate from any copays or deductibles you may owe.

If you get your healthcare through the healthcare marketplace, the monthly premiums will depend on your plan type.

2. Find a quality provider

Choosing providers, doctors, clinics, and hospitals within your insurance network can save you money. When you’re looking for a primary care provider, search for someone who has positive ratings and reviews from other patients.

You can also ask your family and friends for recommendations. At Select Health, our in-network providers are carefully chosen so you can count on easy access to high-quality care.

Use the Select Health Find a Doctortool to search for a specialist or a new primary care provider. It’s designed to help you easily understand your options and find the best providers based on specialty, location, and availability.

3. Consider any big life events

Certain life changes can impact your healthcare needs and their associated costs. Are you planning to have a baby? Maybe you’re anticipating surgery. If so, be aware that these events may require additional coverage or considerations.

If you are planning a major life event, take time to review your plan to ensure it fits your current or future situation. Choose a plan that works for you, and make sure you understand any out-of-pocket costs or coverage needs to avoid surprises down the road.

4. Decide if you need an HSA or FSA

Health savings accounts (HSAs) and flexible spending accounts (FSAs) are two options for managing healthcare costs. Each has distinct benefits.

An HSA is a savings account for people with high-deductible health plans (HDHPs). These HDHPs are health insurance plans with lower premiums and higher deductibles than a traditional health plan.

If you have an HSA, you can set aside pre-tax dollars to pay for qualified medical expenses. In addition, the funds you set aside each year can roll over year after year. HSAs are a good choice for those who want to save for future healthcare expenses.

With an FSA, you can put pre-tax money aside to save on out-of-pocket healthcare costs. One main difference between an FSA and an HSA is that the funds in an FSA generally need to be used within the plan year, or you risk losing them. FSAs can be great if you know you’ll have healthcare costs, like ongoing prescriptions or regular medical treatments.

Are you deciding between an HSA and an FSA? Read more about the differences between HSA and FSAs to learn which might be right for your needs.

5. Look for cost-saving incentives

Did you know that staying proactive about your health can help you save money? Select Health offers wellness rewards that incentivize members to engage in healthy habits and preventive care. These programs are designed to help you manage costs while encouraging overall well-being.

From discounts on gym memberships to rewards for completing health assessments, these incentives can greatly lower your healthcare expenses.

Find the right plan for you.

Select Health offers many different plans for individuals, families, employers and those eligible for Medicare and Medicaid. To find a plan that works best for you, visit our plans page or call 800-538-5038 to speak with an agent.

---

This information does not guarantee benefits. To review your benefits, please reference your plan materials or call Member Services at 800-538-5038 weekdays, from 7:00 a.m. to 8:00 p.m., and Saturday, from 9:00 a.m. to 2:00 p.m., closed Sunday. TTY users call 711.