7 key health insurance terms you should know

These seven terms will make health insurance easier to navigate.

Health insurance has a language all its own. And while you don’t need to be fluent, knowing a few key terms is a good idea. Understanding the lingo can help you the next time you review an EOB (explanation of benefits) or decipher a drug formulary (list of drugs your insurance plan covers).

So, here’s a list of seven key health insurance definitions. Commit them to memory for a savvier customer experience.

What is a health insurance premium?

Health insurance premiums are the monthly fee you pay for your insurance coverage. You might pay your premium directly to the insurance company. If you have employer-sponsored insurance, your employer will take your portion of the premium amount out of your paycheck and pay the insurance company on your behalf.

What are copays?

Copays are a fixed amount you must pay the provider or pharmacy for services and medications.

The copay amount may vary depending on the type of provider you see. When you see a specialist, such as a urologist or dermatologist, you may pay a higher copay than when you visit a primary care provider.

Some plans also require a copay for prescription medicines, lab tests, hospital stays, and other products and services.

What is a health insurance deductible?

A health insurance deductible is an amount you must pay to doctors and facilities before your plan begins to pay for eligible charges.

For example, if your deductible is $500, you must pay the first $500 for healthcare services before health insurance pays anything. Many health insurance plans pay for preventive care, regardless of whether you have met your deductible. That means you won’t pay for annual physicals, dental cleanings, and vaccinations. However, you will still be responsible for any copays.

Your deductible amount resets every year.

What is coinsurance?

After you meet your deductible, you and the insurance company share your healthcare costs. The coinsurance is your portion. It’s typically a percentage of the allowed amount for a service. For example, you may pay 20% of the allowed amount, and the health insurance company pays 80%.

What is an out-of-pocket maximum?

Your out-of-pocket maximum is the most you pay in a given year. Once you meet that amount, your insurance will cover your allowed healthcare services for the rest of the year.

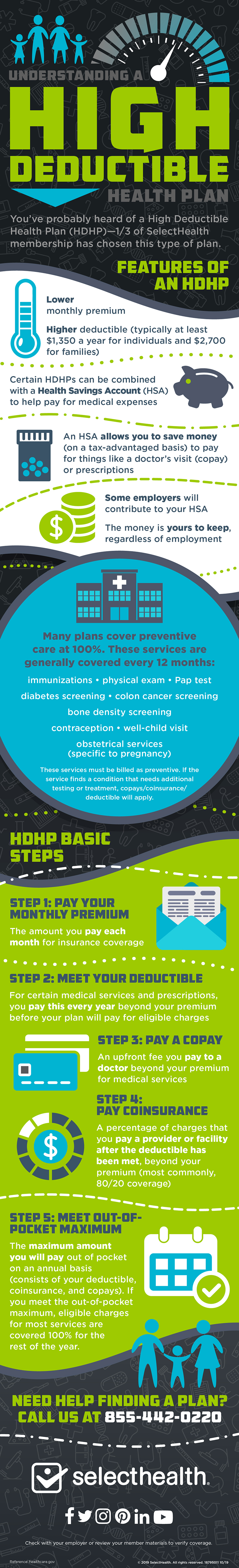

What is a high-deductible health plan?

A high-deductible health plan (HDHP) offers lower monthly premiums than a traditional plan in exchange for a higher deductible. These plans can be a good option for people who don’t have an ongoing need for medical care.

Many people choose an HDHP to have a lower monthly cost and still have the peace of mind that they have insurance should they need it.

What is a health savings account?

A health savings account (HSA) is for people with high-deductible health plans (HDHPs).

If you have an HSA, you can set aside pre-tax dollars to pay for qualified medical expenses. In addition, the funds you set aside can roll over year after year. HSA funds become available for you to use as soon as you deposit them.

HSAs are a good choice for those who want to save for future healthcare expenses.

Learn more about insurance with Select Health

Though health insurance can seem overwhelming, Select Health is here to make insurance simple. You can find more resources on our website, or you can call and speak to an expert.

Member Services is available Monday-Friday from 7 a.m. to 8 p.m. and Saturdays from 9 a.m. to 2 p.m. (TTY:711).