Understanding Health Savings Accounts

Learn the benefits, rules, and limits of an HSA so you can make the most of your money.

If you’re looking for a smart way to save money on healthcare, a Health Savings Account (HSA) might be the right tool. HSAs offer tax advantages and long-term savings potential. They can also help you manage current and future medical expenses.

What is a Health Savings Account (HSA)?

An HSA is a savings account that helps you pay for qualified medical expenses. You can use the money for deductibles, copays, prescriptions, and other out-of-pocket healthcare costs. According to recent data, Americans have saved over $100 billion across 34 million HSA accounts.

Unlike some other savings accounts, the money in an HSA rolls over from year to year. You can still access those funds — even if you change jobs.

Here’s how HSAs compare to other accounts:

- Unlike many FSAs, you don’t lose your balance at the end of the year.

- Unlike HRAs, you (not just your employer) can contribute money.

- Unlike many insurance-based plans, the account stays with you, even when you leave a job or retire.

How does a Health Savings Account work?

An HSA works like a personal savings account, but it’s just for healthcare. You deposit money into the account, and it grows tax-free. You can then use it for qualified medical expenses without paying taxes on the withdrawal.

Many people who have a High-Deductible Health Plan (HDHP) opt for an HSA. Because HDHPs have lower monthly premiums, there can be more room in the budget to set aside money in an HSA.

You can also invest the funds (if your account allows it) to grow your balance over time.

To open and use an HSA, you must:

- Be enrolled in an HDHP

- Not have other disqualifying coverage (such as non-HDHP insurance through a spouse)

- Not be enrolled in Medicare

- Not be claimed as a dependent on someone else’s tax return

Benefits of Health Savings Accounts

HSAs offer several unique advantages. Here are the biggest benefits of an HSA:

Triple tax advantage

- Tax-free contributions: Reduces your taxable income

- Tax-free growth: Earnings from interest or investments are not taxed

- Tax-free withdrawals: When used for qualified medical expenses

Flexibility and portability

- The account is yours, even if you switch jobs or retire

- Unused funds roll over year after year

- Contributions can come from you, your employer, or both

Investment potential

- Many HSA providers offer investment options like mutual funds or ETFs

- Long-term growth can make your HSA a tool for retirement healthcare savings

After age 65, you can use your HSA funds for non-medical expenses without a penalty, though regular income tax will apply.

Drawbacks and considerations

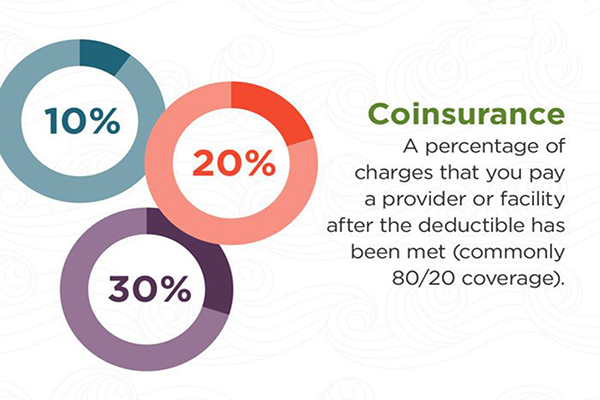

One potential setback of using a Health Savings Account is the high-deductible requirement. You pay more out-of-pocket before coverage kicks in. This could translate to financial pressure when savings in an HSA hasn't built up enough to cover the deductible amount.

HSA funds can only be used for designated medical expenses. As a result, certain health costs are eligible while others aren’t, meaning thoughtful tracking is needed to avoid potential penalties for non-qualified expenses.

Part of managing an HSA is record keeping. Keeping a record of how you’ve spent your HSA money and where will make sure you have it when you need it.

How to use an HSA effectively

To get the most out of your HSA, it’s helpful to consider both short-term and long-term benefits. Your plan choice matters, especially if you enroll in an HDHP, which is a requirement for HSA eligibility.

Choosing the right health insurance plan plays a role in how well your HSA works for you. If you pick the right plan from the start, it’s easier to plan your savings and medical spending.

Here’s how to use your HSA:

- Contribute regularly, ideally up to the yearly limit

- Budget for both short-term and long-term medical needs

- Keep records and receipts for all expenses to make tax time easier

- Use low- or no-cost preventive care when available to reduce avoidable costs

- Consider investing your HSA balance once it reaches a certain threshold

Think of your HSA as both a spending and saving tool. Use it wisely today while preparing for medical costs in the future.

HSA contribution limits and regulations

Each year, the IRS determines the limit on how much you can contribute to your HSA. Staying within those limits is important to avoid penalties and make the most of the account’s tax benefits. Learn how different plan funding models may affect your HSA options.

Here are the contribution limits for 2025:

- Individual coverage: $4,300

- Family coverage: $8,550

- Catch-up contribution: Add an extra $1,000

These limits apply to the total combined amount contributed by you and your employer. If you exceed the limit, the excess could be taxed and may come with an additional penalty. To avoid these consequences, you must withdraw contributions beyond the limit before the tax deadline.

A special provision called the “catch-up contribution” allows people 55 and older to contribute more each year. This is especially helpful for those getting closer to retirement who want to boost their healthcare savings.

HSA rules can change based on legislation, economic factors, or public health emergencies. That’s why it’s important to monitor updates from the IRS or your HSA provider to stay in compliance.

Are HSAs worth it? Evaluating the pros and cons

Understanding whether an HSA is worth it requires you to evaluate your personal financial goals and healthcare needs.

HSAs might be a good fit if:

- You have low expected medical costs

- You want to save money on taxes

- You’re looking for a way to invest in future health expenses

- You’re in a higher income tax bracket

HSAs might not be ideal if:

- You have frequent, high medical expenses

- You can’t afford a high deductible

- You prefer lower out-of-pocket risk over tax savings

How to open and manage a Health Savings Account

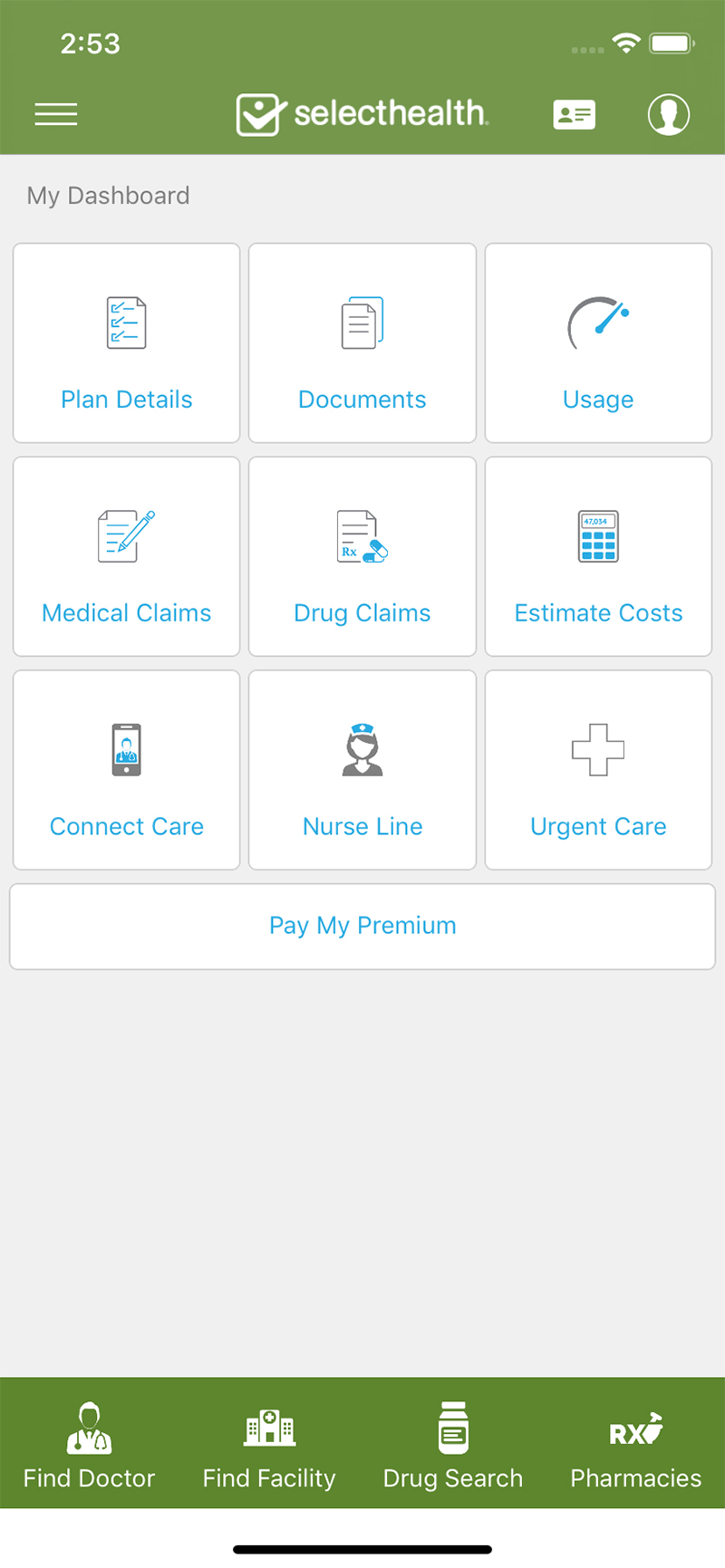

Opening an HSA starts with choosing the right provider. Banks, credit unions, and insurance companies offer HSAs, but not all accounts are the same. Look for a provider that offers:

- Low or no fees

- Good customer support

- Easy account access (online or mobile)

- Clear investment options

- Positive reviews or recommendations

Once you’ve chosen a provider, the setup process is usually quick and straightforward. You’ll fill out an application, online or in person, with your personal details and proof of your enrollment in a qualifying HDHP. After approval, you can begin making contributions.

Managing an HSA doesn’t end at opening it, though. It’s important to:

Set a healthcare budget

Track contributions and spending

Keep receipts for all qualified expenses

Review your account regularly for accuracy

Explore investment options when your balance allows

Explore your HSA options

HSAs can be an asset to those who qualify. You can save money and use it for medical bills as you need it.

To learn more about HSAs and the options we offer, visit SelectHealth.org