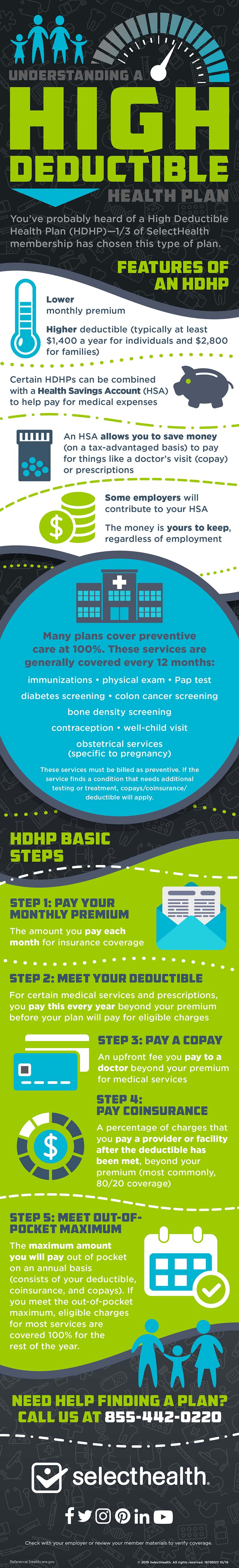

Understanding a High Deductible Health Plan (HDHP)

You’ve probably heard of a High Deductible Health Plan (HDHP). Here’s what it means and what you should expect from a HDHP.

You’ve probably heard of a High Deductible Health Plan (HDHP). Here’s what it means and what you should expect from a HDHP.

Features of a HDHP:

- Lower monthly premium

- Higher deductible (typically at least $1,400 a year for individuals and $2,800 for families)

- Certain HDHPs be combined with a Health Savings Account (HSA) to help pay for medical expenses

- An HSA allows you to save money (free from federal taxes) to pay for things like a doctor visit (copay) or prescriptions

HDHP Basic Steps:

| Step 1: Pay your monthly premium | The amount you pay each month for insurance coverage. |

| Step 2: Meet your deductible | For certain medical services and prescriptions, you pay this every year before your plan will pay for eligible charges. |

| Step 3: Pay a copayment | An upfront fee you pay to a doctor for medical services. |

| Step 4: Pay coinsurance | A percentage of charges that you pay a provider or facility after the deductible has been met (most commonly, 80/20 coverage). |

| Step 5: Out-of-Pocket Maximum | The maximum amount you will pay out of pocket on an annual basis (consists of your deductible, coinsurance, and copayments). If you meet the out-of-pocket maximum, eligible charges for most services are covered 100% for the rest of the year. |

Reference: healthcare.gov