7 surprising things you can buy with your FSA

It’s coming time to use up your FSA dollars!

It’s coming time to use up your Flexible Spending Account (FSA) dollars and you’ll be surprised at the wide variety of things you can purchase with your funds. If you didn’t end up using your banked money for medical bills or expenses, you can purchase health items that you need.

You can use your funds at approved stores, such as pharmacies. If you don’t have a physical FSA debit card that you can use in stores, you can submit receipts to your benefits administrator for reimbursement.

What many people don’t realize is there are hundreds of items that qualify for purchase and reimbursement. Here are a few things that might surprise you.

1. Sunscreen.

Keeping your skin protected from harmful UV rays should always be top-of-mind. If you’ve got some FSA cash to burn before the end of the year, consider stocking up on sunscreen. Those products that are both a minimum of 15 SPF and protect from both UAB and UAV rays are eligible for reimbursement.

2. Lotion.

Utah’s winters are harsh on skin. Keeping up with lotion and extra hydration is key to staying comfortable the next few months. Certain lotions may be eligible for reimbursement. Check with your benefits manager to see what qualifies.

3. Feminine hygiene products.

Updated rules under the CARES Act now allow menstrual care products to be eligible for reimbursement from FSA funds. Using your pre-tax dollars to buy period products is a great way to save a little extra money each month.

4. Over-the-counter medications.

Reduce those cold or allergy symptoms with over-the counter meds. Use your FSA to get over-the-counter medications for symptoms you might experience. If you’ve got some extra money to use up, consider stocking up on antacids, cold medications, and even pain management medications like ibuprofen.

5. Eyeglasses, contacts, cleaners, and accessories.

Prescription glasses, contact lenses, and materials used for contact lenses, such as saline solution and enzyme cleaner needed to keep your eyewear in top shape are all qualified medical expenses. You can submit receipts to your benefits manager to use your balance.

Be sure to check with your FSA manager before making any purchases.

6. Breast pump and supplies.

Hundreds of mom and baby products are eligible for reimbursement. New or expecting parents can use their FSA funds to cover the cost of a breast pump and other nursing supplies. There are several breast pumps eligible for coverage, in addition to breastmilk coolers, storage bags, nursing pads, and more.

7. Blood pressure monitors.

Working to keep your blood pressure in check? Use your FSA dollars to buy a blood pressure monitor to easily track your numbers at home.

Other monitors may also be eligible, such as blood glucose monitors and kits.

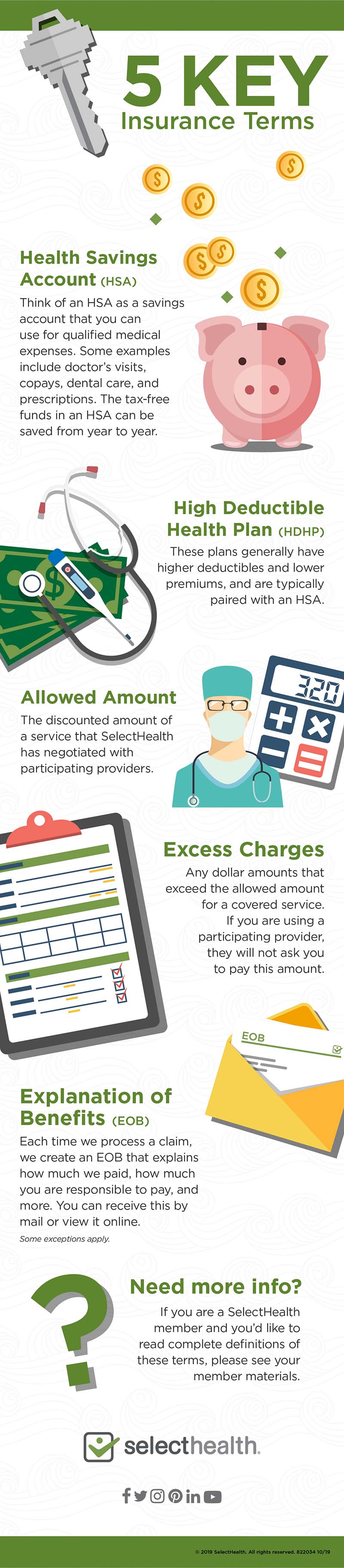

Understanding the difference between HSA and FSA.

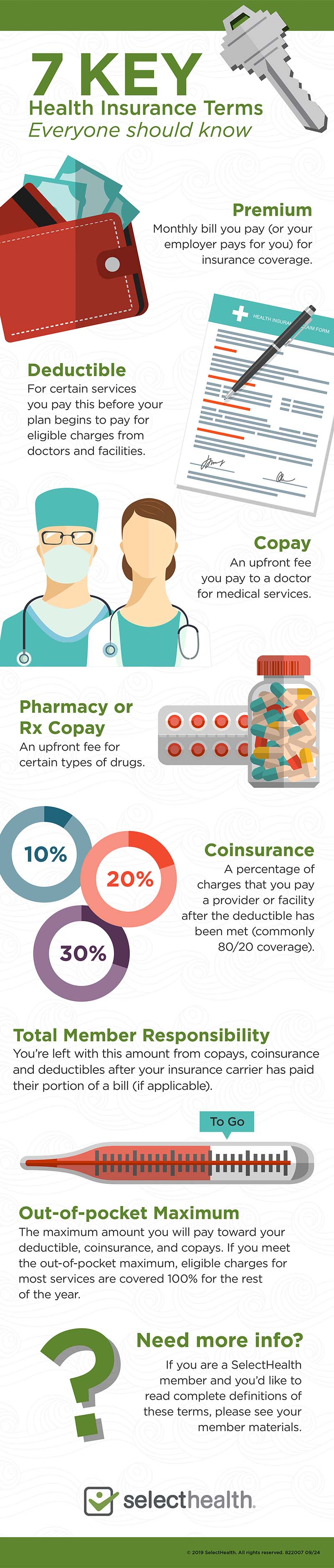

Both Health Savings Accounts (HSAs) and FSAs are smart ways to save on healthcare expenses. They allow you to set aside money each month for potential healthcare expenses. But the two account types involve different savings avenues.

FSA.

A flexible spending account is usually offered through your employer. It allows you to set aside pre-tax dollars for qualified medical expenses. However, the funds are often “use it or lose it,” meaning if you don’t spend them by the end of the year (or a grace period), you lose the balance in your FSA account. Some FSAs may allow for a limited rollover amount.

HSA.

A health savings account is tied to qualified high-deductible health plans. The money you contribute to an HSA rolls over year after year, so you don’t have to worry about losing it. HSAs also offer triple tax benefits: contributions can be tax-deductible, earnings can grow tax-free, and withdrawals for qualified expenses are generally tax-free.

Check your FSA balance.

It’s easy to lose track of how much you’ve spent from your FSA account. To ensure you’re on top of your budget, check your balance before making any purchases.

If you don’t have an FSA or HSA but are interested in setting one up, open enrollment is the perfect time to learn more and sign up. Learn more about Select Health plans here.

---

This article provides general information and is not intended as legal or tax advice. Select Health makes no guarantee regarding its accuracy or completeness. Guidelines frequently change and you should consult with a tax professional for specific advice about these topics and your situation.