7 Steps to Make Medicare Work Better for You

Medicare is a federal health insurance program that pays for a number of covered health services.

The ABCs of Medicare and Different Plan Types

FIRST THINGS FIRST, WHAT IS MEDICARE?

Medicare is a federal health insurance program that pays for several covered health services. Generally, you’re eligible for Medicare if you (or your spouse) worked for at least 10 years and contributed taxes to fund your Medicare benefits, are 65 years or older, and a U.S. citizen or permanent resident. If you’re younger than 65, you may qualify for coverage if you have a disability or End-Stage Renal Disease (ESRD), which is permanent kidney failure requiring dialysis or transplant.

Choosing the right plan is not only important, it’s personal. To sort things out, it is best to know all your options. So, what are the differences between Medicare Parts A, B, C, and D?

ORIGINAL MEDICARE—your government plan—is only PART A and PART B.

Part A is hospital coverage.

Part B is medical coverage. You must pay a premium each month.

PART C combines your hospital, medical, and typically even your drug coverage into one complete plan. You may need to pay an additional premium each month.

Part D is prescription drug coverage only.

Think of Medicare Advantage (PART C) as ALL-IN-ONE coverage.

You get hospital and basic medical care coverage, like preventive services and inpatient and outpatient care, plus many plans offer supplemental benefits for vision, dental,and hearing. You get all the benefits of Original Medicare, plus predictable copayments that make it easy to budget, a cap on your out-of-pocket maximum, and coverage for preventive screenings.

There are also Medicare Supplement or Medigap plans. These types of plans have an additional premium but only cover costs of some of the care Original Medicare doesn’t cover. These plans often don’t include any additional perks or optional benefits.When it comes to Medicare, there isn’t a one-size-fits-all option. Give us a call or work with a licensed insurance agent to better understand your options and decide what’s right for YOU.

What’s Your Medication Situation?

Many of us take one or more medications on a regular basis. It important to review the annual drug formulary to ensure there haven’t been any coverage changes. When reviewing your drug formulary, make sure to check:

> Drug brand names and generics

> Drug brand names and generics

> Prior authorization requirements (additional hoops to jump through)

> Limited pharmacy access (some drugs are only available at specific pharmacies)

> Prescription tiers and the associated cost

There are a lot of tools out there that allow you to shop plans and compare drug costs between Medicare Advantage and Prescription Drug Plans. Call us or your insurance agent and request a free drug analysis.

Choosing the Right Plan for You

Things change, people change, plans change, life changes. What may have been a great plan may not suit your needs anymore. Remember to review your plan and coverage every year. Just like when you shop for any other plan, always keep your eyes out for:

Provider and facility networks: IN-NETWORK VERSUS OUT-OF-NETWORK

In-network or participating providers and facilities participate on your plan’s network. These providers must write off (in other words, can’t bill you for) charges—for covered services—that exceed the allowed amount (these are called excess charges).If a provider is out-of-network, he or she does not participate on your plan’s network and does not accept the allowed amount as payment in full. Your plan may not cover services from an out-of-network provider and that means you may end up responsible for paying the excess charges for services.

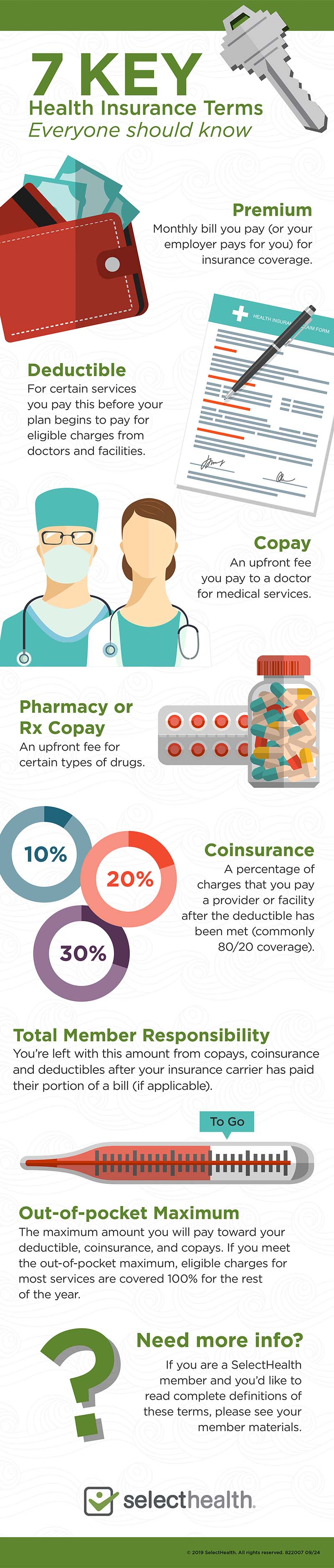

Monthly premiums: This is the monthly bill you pay for insurance coverage (to be a member of an insurance plan).

Annual deductibles: This is an amount you must pay to doctors and facilities before your plan begins to pay for eligible charges. (But remember, you’re still only paying the allowed amount for covered services from in-network providers!) Some categories of benefits may have a separate deductible.

Out-of-pocket (OOP) maximums: This is the total amount you may pay for services covered by your plan each year. Amounts you pay toward your deductible, coinsurance, and copays apply to your out-of-pocket maximum. Some plans have separate medical and pharmacy deductibles, and some services may not apply to or may exceed the OOP maximum.

Remember: The premium you pay for your plan does not apply to your out-of-pocket maximum or other amounts you must pay for covered services (see Monthly premiums).Out-of-pocket maximums are often overlooked when estimating annual healthcare costs. Depending on the plan you choose, you could end up with a “sky’s the limit” out-of-pocket cost!

Original Medicare typically pays 80 percent and you pay 20 percent. But there is NO out-of-pocket limit. With Medicare Advantage, your out-of-pocket costs are limited a to specific amount each year. Don’t forget to check your plan for those out-of-pocket costs every year when it comes time for renewal.

Visit copays and coinsurance: This is an amount you must pay the doctor for services. Most plans have lower copays for primary care providers and higher copays for secondary care providers.

What about coinsurance? While a copay is often a fixed amount, coinsurance is usually a percentage of the cost you pay after you reach your deductible.

Referral requirements: What if you need to see a specialist? With many plans, a referral from your primary care provider is required before you can seek any specialized care; without that prior approval, you may be responsible for footing the bill. That is a cost you will want to avoid.

BONUS PERKS: What options, tools, and services are included on your plan? Find out about gym memberships, wellness discounts, vision and dental, and other extras. Some of these perks may cost more. Consider things like glasses, eye exams, dental cleanings, and other dental services. Many plans will cover the basics for vision and dental, but if you need special bifocals or a dental procedure, you may end up paying through the teeth. Other perks may be gym memberships or discounts. Take a look to see how they fit your budget, lifestyle, and needs.

Be in Good Company

Choosing the right plan is hard—wading through the hundreds of insurance companies can be downright exhausting. For starters, there are several categories to consider:

NOT-FOR-PROFIT VS. FOR-PROFIT Who is the priority—you or shareholders? For-profit companies must return profits to investors while not-for-profits must reinvest their profits back into the plan to benefit members.

LOCAL VS. NATIONAL Local insurance companies know and likely use the same facilities, doctors, and resources, and they work with them to provide the highest quality services at the most affordable prices. Local companies often employ local representatives who have the local know-how to make sure you get the service you need. They can also offer local discounts, classes, and programs throughout the community. National companies do not have that local expertise, but they may have broader coverage with a national footprint.

CUSTOMER SERVICE YOU DESERVE

Customer service is a big deal! Can you talk to a local person on the phone? Do you have to wait on hold and jump through a thousand hoops just to be told a generic answer? When you need answers, you need a real person to make things happen for you.

WHERE EVERYBODY KNOWS YOUR NAME

Well, maybe not everybody knows your name, but this goes back to the advantage of going local. When comparing companies, make sure to check the plan network. Are your current providers and facilities in the network? If not, are there better local providers to serve your healthcare needs?

THE STARS ALIGNED FOR YOU

The Centers for Medicare and Medicaid Services (CMS) use a five-star quality rating system to evaluate health plans. The Star Rating can tell you a lot about a company’s customer service, member satisfaction, benefits, and overall quality. Pay attention to those stars! Based on real members’ answers to surveys and questionnaires, companies receive updated ratings annually. These rankings make it easy to weed out less than the best.

Dates to Remember

You do not want to miss enrollment; otherwise, you will end up waiting another year for coverage. So, as they say, carpe diem! There is no time better than the present to review your plan and make changes if needed. After you have compared plans and prices, it’s a good idea to call the insurance company representative or talk with a licensed insurance agent. Make sure you do all of this with ample time because you won’t want to miss out on your enrollment period.

TAKE A LOOK AT THESE IMPORTANT DATES:

FIRST-TIME MEDICARE ENROLLMENT Turning 65?You have a seven-month window around your birthday month.

That is: Three months before your birthday month, three months after your birthday month, and of course, your birthday month. (P.S. Happy Birthday!)

ANNUAL ENROLLMENT PERIOD

Mark your calendars. Every year from October 15 to December 7 you are allowed to make changes and switch plans. This is a great opportunity to review your coverage to make sure it still works for you.

MEDICARE ADVANTAGE OPEN ENROLLMENT PERIOD

An enrollment period specifically for Medicare Advantage members. From January 1 to March 31 you have a one-time opportunity to change plans. That means you may elect to move to another Medicare Advantage plan, or you may cancel your plan to return to Original Medicare. You may also add Part D during this period for prescription drug coverage (if it isn’t included on your Advantage plan). Remember that this is a one-time per year plan change.

SPECIAL ENROLLMENT PERIODS

Special is the key word here. These periods are reserved for specific situations. Here is a sample list of those Special Enrollment Periods:

> Lost other creditable employer or retiree insurance coverage benefits

> Have both Medicare and Medicaid

> Moved out of your geographical service area

> Qualify for low-income prescription drug assistance

*If you have Medicare due to a disability but are not yet 65 years old, you may also have a special enrollment period when you turn 65.

What You Need to Know About SSA, HSAs, and Delaying Medicare

If you are still planning to work and not retired by the time you turn 65, there’s still a few things you need to know.

DELAYING MEDICARE AND THE LATE ENROLLMENT PENALTY

You can continue to work and delay Medicare by staying on your employer’s health plan. However, not every employer plan is the same and, in some cases, you may incur a Late Enrollment Penalty (LEP) if your coverage is not considered creditable. The thing about the LEP is that it follows you until death. That means, if you incur a LEP, you will have to pay this penalty forevermore. Even if you plan on working past 65, it’s a good idea to give us a call or work with a licensed insurance agent to verify your coverage status and avoid any lifelong penalties.

WHAT HAPPENS TO YOUR HSA ONCE YOU’RE ON MEDICARE?

Once you are on Medicare, you can no longer contribute to an Health Savings Account (HSA). However, anything you’ve saved in your HSA can be used towards qualifying medical expenses for the rest of your life. This includes paying for Medicare and Medicare Advantage premiums, tax- and penalty-free! But note that you cannot use your HSA to pay for Medicare Supplement insurance premiums.

SOCIAL SECURITY ADMINISTRATION

If you are receiving Social Security benefits prior to age 65, your Medicare card will automatically arrive in the mail about 90 days before your 65th birthday. What happens if you delay Social Security beyond 65? Like we said, everyone’s situation is unique. Give us a call and we can walk you through your personal path to Medicare.

Ready, Set, Go. What’s Next?

You’ve done your homework and you’re ready! If you’ve decided to enroll in a Select Health Medicare Advantage plan, let’s get to know each other! We would like to chat with you to make sure you understand everything about your soon-to-be plan, network, benefits, and contacts. Call us today to get started.

For more information about Medicare Plans or Select Health Advantage (HMO, HMO-SNP), call us toll-free 855-442-9940 (TTY: 711).

Select Health is an HMO, HMO-SNP plan sponsor with a Medicare contract. Enrollment in Select Health Advantage depends on contract renewal. Other providers are available in our network. Select Health complies with applicable Federal civil rights laws and does not discriminate on the basis of race, color, national origin, age, disability, or sex.

ATENCIÓN: Si habla español, tiene a su disposición servicios gratuitos de asistencia lingüística. Llame a: 1-855-442-9900 (TTY: 711)

注意:如果您使用繁體中文,您可以免費獲得語言援助服務。請致電 1-855-442-9900 (TTY: 711)。

© 2019 Select Health. All rights reserved. 2393943 09/19 H1994_2393943_C